Turbocharged

Instant Asset

Write-Off Scheme

Write off any eligible depreciable asset till 30 June 2022

Did you catch the announcement that businesses, both big and small, can now immediately write off any eligible depreciable asset, at any cost, up until 30 June 2022?

Well, that’s any business with a turnover of up to $5 billion.

How does it work?

The Instant Asset Write-Off is a tax deduction which reduces the tax liability of your business. It enables businesses to claim an upfront deduction for depreciating assets in the year the asset was purchased and used (or installed ready for use).

Let’s look at the scheme in more detail…

The government is calling the new initiative “temporary full expensing”.

But to put it more simply, it looks like an expanded version of the popular instant asset write-off scheme, which was previously only available for small and medium-sized businesses (SMEs) and for assets up to $150,000.

Now, however, any business with a turnover of up to $5 billion can immediately deduct the full cost of any depreciable asset purchased from 6 October 2020 and first used or installed by 30 June 2022.

The cost of improvements made during this period to existing eligible depreciable assets can also be fully deducted.

There are a few key details you should be aware of, especially when purchasing second-hand assets:

- Full expensing also applies to second-hand assets for SMEs (with an aggregated annual turnover of less than $50 million).

- Businesses with aggregated annual turnover between $50 million and $500 million can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31 December 2020 under the existing instant asset write-off scheme.

- SMEs that acquire eligible new or second-hand assets under the $150,000 instant asset write-off by 31 December 2020 will also have an extra six months, until 30 June 2021, to first use or install those assets.

If you’d like help obtaining finance to make the most of temporary full expensing for your business, contact us now!

Related: How the instant asset write-off applies to vehicles

What to claim and when:

CASE STUDY

Provided by ATO

Grace owns an agricultural company, Grace’s Grains Pty Ltd, which has an aggregated annual turnover of $20 million for the 2021-22 income year.

Grace’s Grains Pty Ltd purchases a combine harvester for $600,000, exclusive of GST, on 1 July 2021. Without temporary full expensing, Grace’s Grains Pty Ltd would claim a total tax deduction of around $180,000 for 2021–22, with the remainder of the cost being depreciated over future years.

Under temporary full expensing, however, Grace’s Grains Pty Ltd will instead claim a deduction of $600,000 for the full cost of the combine harvester in 2021–22, approximately $420,000 more than before.

At the 2021–22 tax rate for small and medium companies of 25%, Grace’s Grains Pty Ltd will pay around $105,000 less tax in 2021–22.

This will improve the company’s cash flow and help Grace reinvest and grow her business.

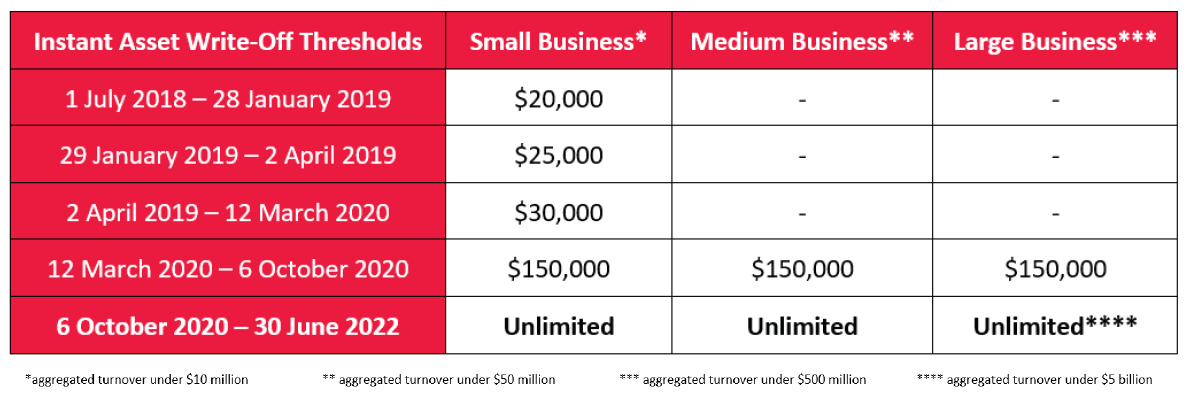

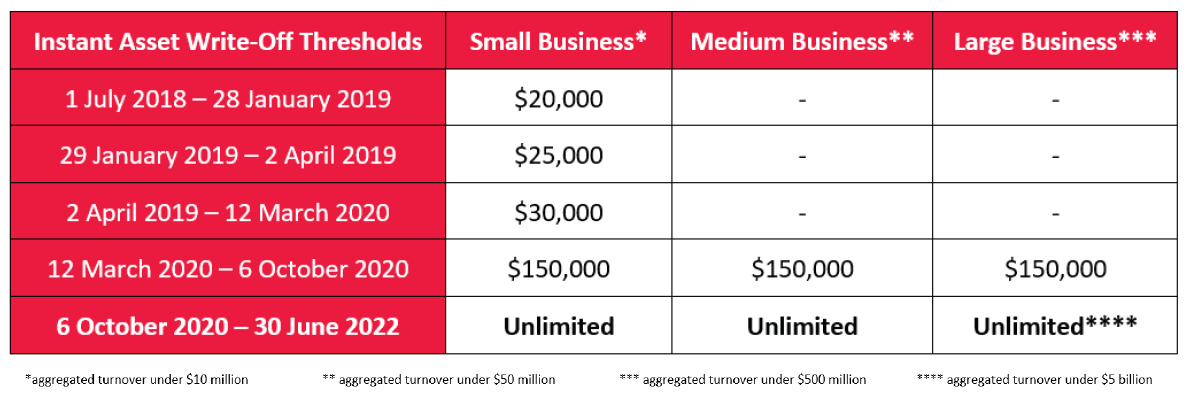

THRESHHOLDS

1 Jul 18 – 28 Jan 19

1 Jul 18 – 28 Jan 19

1 Jul 18 – 28 Jan 19

1 Jul 18 – 28 Jan 19

1 Jul 18 – 28 Jan 19

THRESHHOLDS

$25,000

$30,000

$150,000

Unlimited

THRESHHOLDS

–

–

$150,000

Unlimited

THRESHHOLDS

–

–

$150,000

Unlimited****